Mining Legend Ross Beaty Says, "DO NOT SELL This Gold Miner Cycle"

But is this time actually different for Gold, Silver, Copper, and Uranium Mining Stocks?

Part 1 of 2

Is This Time Really Different for Gold and Silver Miners?

"Investors in the space today should hold — if stocks go up 10 percent, do not sell, hang on. Because when the move happens it'll be a really beautiful move," warns mining industry legend Ross Beaty in his latest 2025 outlook.

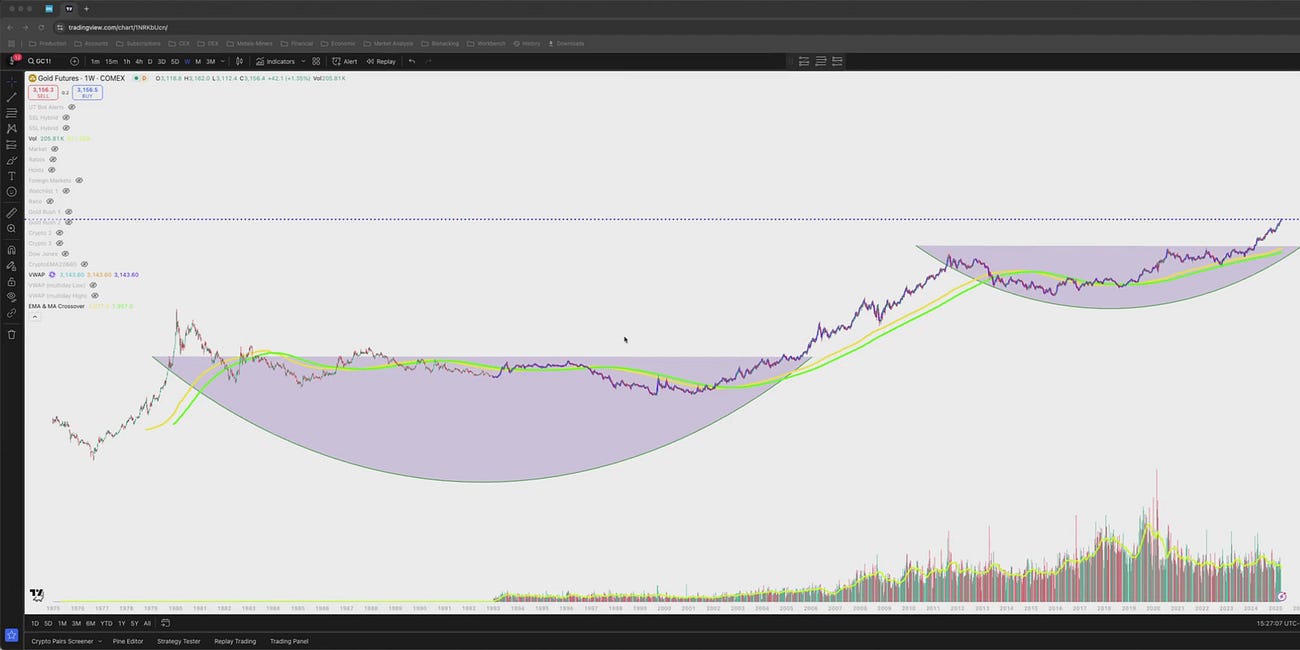

The question every mining investor is asking: Is this the real breakout, or another false dawn like 2011?

After analyzing balance sheets, management quality, capital flows, and geopolitical supply chains, the evidence suggests this mining supercycle has structural advantages that the 2011 boom lacked. Here's why "DO NOT SELL" might be the most important advice for the next decade.

The Two Pillars That Changed Everything

Pillar 1: Balance Sheet Revolution - Cash Flow Machines, Not Debt Bombs

2011 Cycle: Mining companies were leveraged disasters waiting to happen. When commodity prices crashed, overleveraged miners collapsed under debt burdens.

2025 Cycle: The transformation is striking.

Less than 10% of major mining companies now have net debt-to-EBITDA ratios above 2.5x, indicating remarkably strong balance sheets compared to the debt-fueled expansion of 2011. Major miners have focused obsessively on debt reduction since 2016 - debt levels fell almost 25% from 2014-2016 as companies prioritized balance sheet repair.

The Cash Flow Advantage:

Barrick Gold generates enough cash to pay both base dividends AND performance dividends

BHP maintains a 55% dividend payout ratio while funding growth projects

Rio Tinto completed its $6.7 billion acquisition of Arcadium Lithium in March 2025, using existing balance sheet strength

Record cash flows are funding expansion without debt leverage

Unlike 2011's credit-fueled expansion, today's miners are self-funding growth through operational cash generation.

Pillar 2: Management Evolution - Professional Capital Allocation vs. Empire Building

2011 Cycle: Management teams often pursued growth at any cost, making acquisitions at peak valuations and destroying shareholder value.

2025 Cycle: A new generation of disciplined management teams has emerged.

Evidence of Professional Management:

BHP Group uses "programmatic M&A strategy" - small, regular deals rather than mega-acquisitions

Rio Tinto strategically exits coal while investing $2.5B in Argentina lithium projects

Companies now use internal long-term price forecasts rather than reacting to spot price volatility

All major mining CEOs surveyed plan strategic transactions in 2025, but focused on value creation

Mining investment grew 10% in 2023, with lithium specialists leading the charge. The difference: investors are backing management teams with proven track records rather than promotional stories.

Capital Discipline Examples:

Companies save more during upcycles and continue strategic buying during downcycles

Target financing portfolios beyond simple deleveraging

Risk-based approach to capital allocation with clear through-cycle metrics

The management quality upgrade from promotional mining executives to professional capital allocators represents a structural shift.

Why This Foundation Matters

The combination of fortress balance sheets and professional management creates something the mining industry has never had before: the ability to compound wealth through commodity cycles rather than just survive them.

Previous mining booms always ended the same way - when prices fell, overleveraged companies with poor management went bankrupt or destroyed shareholder value through desperate moves.

This cycle has companies that can:

Fund growth without taking on dangerous debt

Make disciplined acquisitions during downturns

Return capital to shareholders consistently

Invest in the best projects rather than the most available

When Ross Beaty says "hang on" for the "really beautiful move," he's betting on more than just commodity prices. He's betting on an industry that finally learned how to manage money.

What's Coming in Part 2

The balance sheet revolution and management evolution are just the foundation. Part 2 will cover the two catalysts that make this foundation explosive:

The Great Rotation: Why $770 billion is shifting from SPX to commodities

Geopolitical Supply Shock: How China's export restrictions create permanent scarcity across uranium, platinum, rare earths, and critical minerals

Plus the sector-by-sector breakdown of asymmetric opportunities and the investment framework for maximum leverage.

Continue reading Part 2: The Supply Crisis That Changes Everything

Mark, you’ve been saying it’s going higher since 18, haha nice :)

Silver going up